Professor Glenn A. Okun

NYU Stern School of Business

August 3, 2023

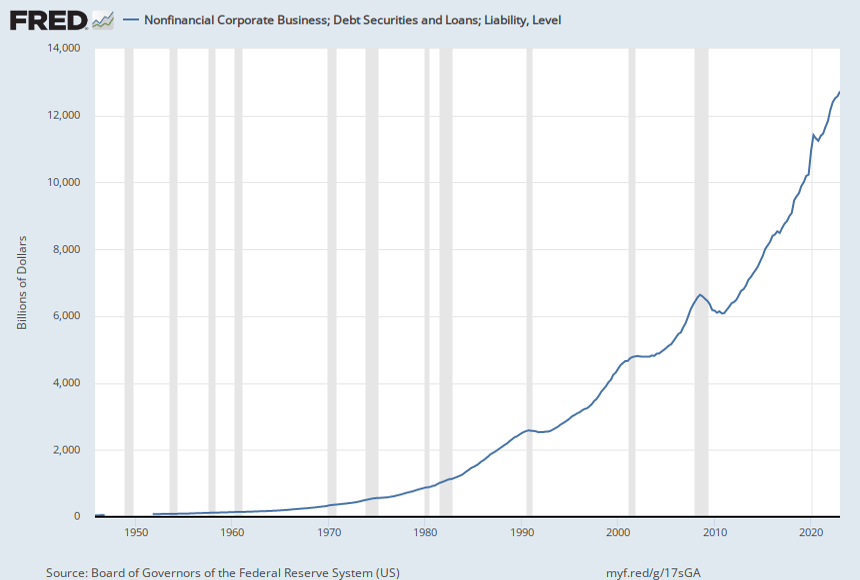

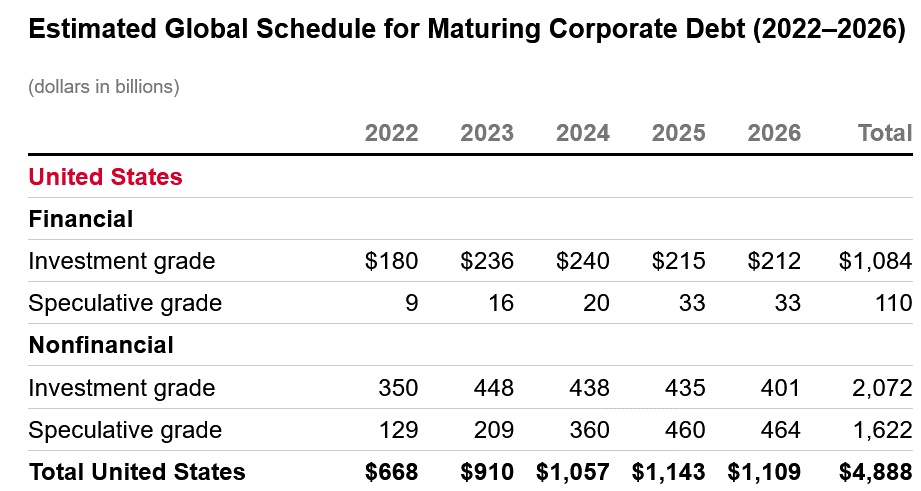

These are not pretty pictures. More corporate debt is maturing over the next four years, in excess of $4 trillion, than the total volume of corporate debt outstanding in the late 1990s. It is coming due under adverse circumstances:

- Substantially higher interest rates,

- Significantly lower valuation multiples,

- Significantly tighter lending requirements (terms and conditions) and

- Significantly diminished debt availability due to the constraints of banks and the debt capital markets.

This will at minimum trigger isolated but sizeable defaults due to refinancings that fail to cover the loan balance. The borrowers cannot satisfy the valuation and cash flow coverage criteria of current underwriting standards at the required loan amount. These defaults will damage individual lender’s financial performance and ability to supply credit. According to the Federal Reserve, it could cause shortages of credit, impairing the growth of the U.S. economy regionally.

The sole optimistic scenario is one in which the Federal Reserve drastically cuts interest rates with the same speed with which it increased them. This is a low probability outcome given the likely persistence of inflation in excess of the target rate.

These dismal conditions create an interesting investment opportunity. Historically, the investment strategy has been referred to as funding the liquidity gap. This approach, used by Warren Buffett and the late Sam Zell, among others, creates attractive investment returns by providing capital during a temporary (cyclical) drought in the capital markets. By funding when investors are fleeing a market or industry, the liquidity disruption caused by this stampede positions the financier with the bargaining power to demand unusually attractive terms and rates of return. When the liquidity later returns, the investors’ returns have been earned.

Risk management is critical. This strategy only succeeds if the capital shortage is cyclical, not secular. If the liquidity does not return, losses will ensue.

Historically, only institutional investors could fund the liquidity gap. This time is different. Individual investors can participate in the private credit alternative investment asset class through publicly traded business development companies (“BDCs”). Bloomberg estimates that BDCs control 25 percent of the total private credit capital available.

These firms are closed end funds that operate as nonbank lenders, providing loans to borrowers of varied sizes in a wide variety of industries. Currently, many are trading with dividend yields in excess of 10 percent. Most are valued at a discount to their asset value, another potential source of investment return. Some are managed by well-regarded institutional alternative asset managers known for rigorous underwriting and low default rates.

In my opinion, private credit investing through publicly traded BDCs is one of the most attractive investment opportunities today. If you want to know more, join me at therabidcapitalist.wordpress.com.

Leave a comment