Professor Glenn A. Okun

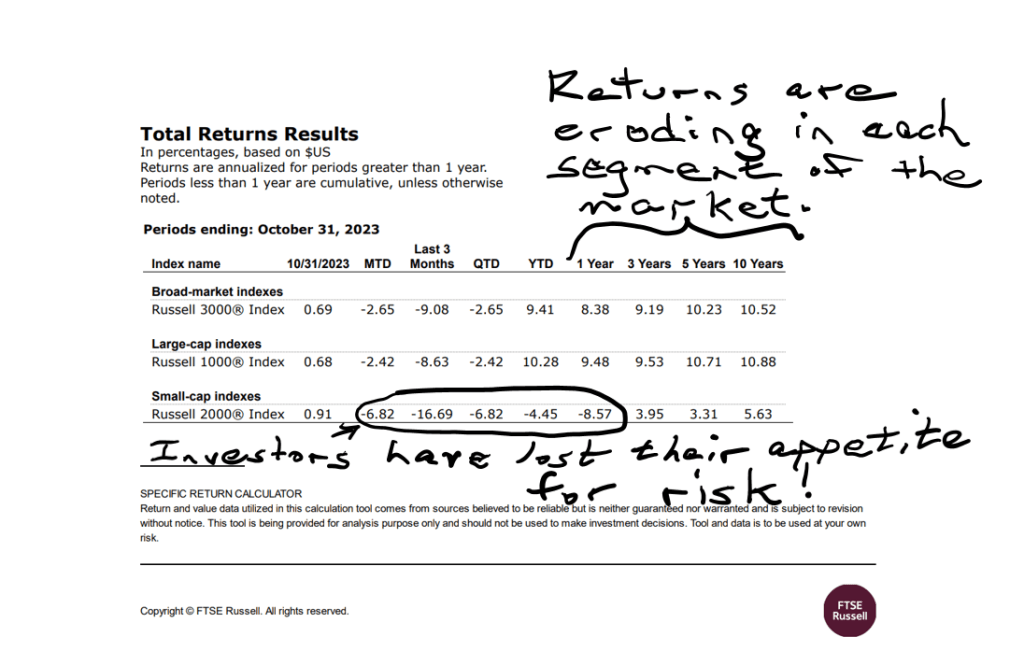

Despite a stellar week in the stock market, the Rabid Capitalist advises caution. It could be a head fake. The economic and market environment are showing symptoms of decline. Momentum has been consistently negative. Negative surprises far outnumber the positive.

The Rabid Capitalist has identified many looming threats to the economy and the market. They dominate the environment. The long list includes:

- anemic bank lending (see https://therabidcapitalist.com/2023/07/25/bank-lending-diet-or-starvation/);

- venture capital investing (see https://therabidcapitalist.com/2023/07/28/venture-capitalists-take-their-own-medicine/);

- corporate debt maturity cliff (see https://therabidcapitalist.com/2023/08/03/another-looming-debt-crisis-and-an-investment-opportunity/);

- multifamily mortgage refinancing threat (see https://therabidcapitalist.com/2023/08/07/another-approaching-storm-multifamily-commercial-mortgages/);

- private equity liquidity drought (see https://therabidcapitalist.com/2023/08/07/private-equity-drought-the-next-liquidity-squeeze/);

- IPO market collapse (see https://therabidcapitalist.com/2023/08/14/beware-the-ipo-head-fake-2/);

- global financial stability warning (see https://therabidcapitalist.com/2023/09/05/global-financial-stability-warning/);

- bankruptcy volume (see https://therabidcapitalist.com/2023/09/05/the-bankruptcy-wave-has-begun-look-out-below/);

- consumer spending fatigue (see https://therabidcapitalist.com/2023/09/06/consumer-fatigue/);

- green investment collapse (see https://therabidcapitalist.com/2023/09/21/it-is-not-easy-being-green/);

- fintech wreck (see https://therabidcapitalist.com/2023/09/23/fintech-wreck/);

- alternative investments drought (see https://therabidcapitalist.com/2023/09/27/alternative-investing-drought-2/);

- the small cap value trap (see https://therabidcapitalist.com/2023/09/27/the-small-cap-trap-do-not-swing-at-the-pitch/);

- the office real estate vacancy overhang (see https://therabidcapitalist.com/2023/09/28/going-off-on-the-office-market/);

- the narrow breadth of the U.S. stock market (see https://therabidcapitalist.com/2023/10/02/the-magnificent-seven-are-losing-their-luster/);

- the hybrid work economic threat (see https://therabidcapitalist.com/2023/10/03/hybrid-work-threatens-the-downtown-economy/);

- the shipping industry retrenchment (see https://therabidcapitalist.com/2023/10/10/shipping-sinks-the-economy-will-stink/);

- electric vehicle adoption issues (see https://therabidcapitalist.com/2023/10/16/hybrids-are-hot-evs-are-not/); and

- auto loan delinquencies (see https://therabidcapitalist.com/2023/10/22/car-loan-delinquencies-hit-an-all-time-high/).

Suffice it to say, the negatives and threats are many and potentially mighty, demanding defensive investing. We will need additional evidence of economic expansion in order to resume a growth investment posture.

Leave a comment