Professor Glenn A. Okun

Last week, Tesla delivered quarterly operating and financial results that disappointed previously diminished expectations. Elon Musk’s bold pronouncements regarding Tesla’s future products dominated the earnings call. The Rabid Capitalist perceived this event as an attempt at the magician’s tactic of misdirection, hoping to distract investors’ attention from actual performance.

The teleconference was a litany of operational and financial disappointments. Tesla’s revenue fell by ten percent compared with the first quarter of 2023. It was the first decline since the pandemic. Price discounts failed to rejuvenate car sales. Quarterly profit collapsed to $1.13 billion, declining in excess of fifty percent relative to the previous year.

Unsurprisingly, the future was the focus of the event. New products and technologies were vaguely discussed. Hard questions regarding the progress, timing and financial potential of those innovations were largely dismissed as subjects for a future call.

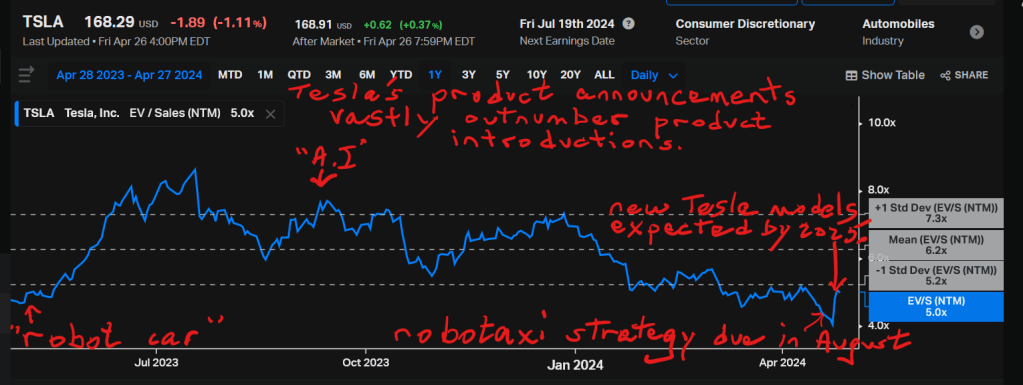

This has been the history of Tesla: celebrate good results and distract attention from the bad. The latter effort has always required misdirection by new product and technology announcements.

The Rabid Capitalist cannot avoid noticing that the frequency of these futuristic proclamations has increased and the effect on the stock price has declined.

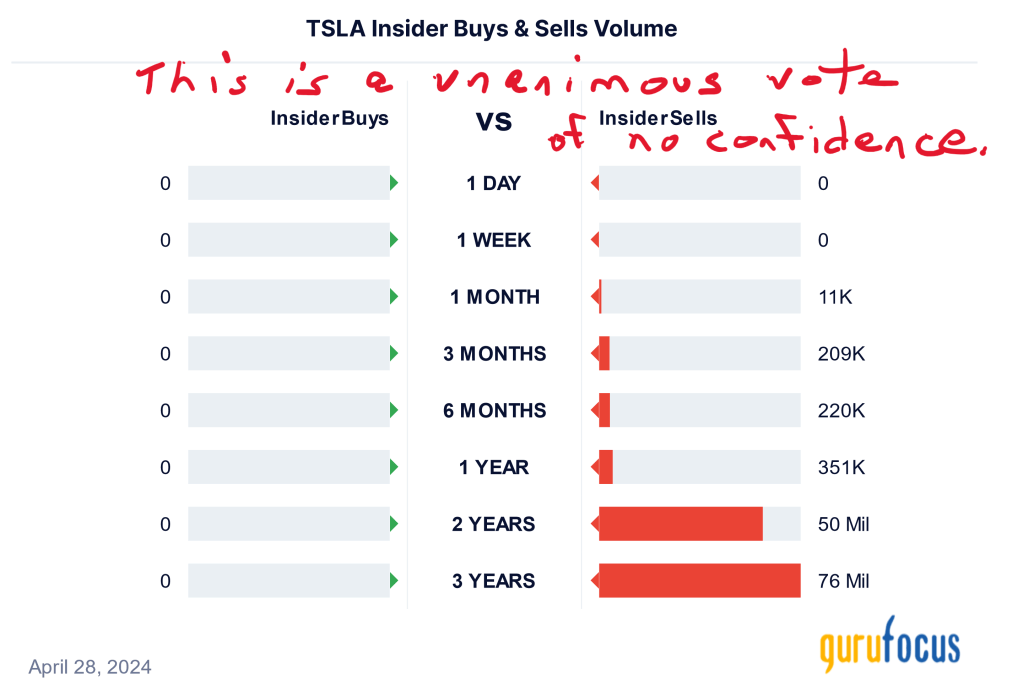

Investor confidence has waned. Despite a short-term bounce in the stock, the market has reacted negatively to Tesla’s “fake it until you make it” approach.

The technological constraints and demand challenges of electric vehicles (see https://therabidcapitalist.com/2024/03/03/tesla-touts-itself-faster-than-the-roadster-can-go-from-zero-to-sixty-miles-per-hour-2/, https://therabidcapitalist.com/2024/02/26/the-tide-goes-out-on-electric-vehicles/ and https://therabidcapitalist.com/2024/03/30/teslas-advertising-signifies-that-it-is-an-auto-maker-not-a-tech-company/) prevent short-term favorable results for Tesla. The stock should be viewed as a long-term bet on commercially valuable innovation.

The Rabid Capitalist expects that Tesla will face a rocky road of investor skepticism due to the sheer number of unfulfilled futuristic promises made by the company. It is not an attractive investment at this time.

| DISCLAIMER: The Rabid Capitalist and all of its associated properties are owned by Cognitor Consulting LLC (“Cognitor”). Cognitor is a publisher of financial information. |

| Cognitor is not a financial adviser. Cognitor does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser. |

| THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION |

| No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. |

| The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions. |

| Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Cognitor undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material. |

| Cognitor does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. |

| By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law. |

| Cognitor publishes content through WordPress, an email newsletter platform. By accessing Cognitor’s content, you agree to be bound by the Terms of Use and Privacy Policy, in effect at the time you access this website or any page thereof or any of Cognitor’s content. The Terms of Use and Privacy Policy may be amended from time to time. Nothing on this website or Cognitor constitute an offer to sell, or a solicitation of an offer to buy or subscribe for, any securities to any person in any jurisdiction where such an offer or solicitation is against the law or to anyone to whom it is unlawful to make such offer or solicitation. Cognitor is not an underwriter, broker-dealer, Title III crowdfunding portal or a valuation service and does not engage in any activities requiring any such registration. Cognitor does not provide advice on investments or structure transactions. Offerings made under Regulation A under the U.S. Securities Act of 1933, as amended (the “Securities Act”) are available to U.S. investors ONLY who are “accredited investors” as defined by Rule 501 of Regulation D under the Securities Act well as non-accredited investors, who are subject to certain investment limitations as set forth in Regulation A under the Securities Act. In order to invest in Regulation A offerings, investors may be asked to fill out a certification and provide necessary documentation as proof of your income and/or net worth to verify that you are qualified to invest in offerings posted on this website. All securities listed on this site are being offered by, and all information included on this site is the responsibility of, the applicable issuer of such securities. Cognitor does not verify the adequacy, accuracy or completeness of any information. Neither Cognitor nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy, valuations of securities or completeness of any information on this site or the use of information on this site. Neither Cognitor nor any of its directors, officers, employees, representatives, affiliates or agents shall have any liability whatsoever arising from any error or incompleteness of fact, or lack of care in the preparation of, any of the materials posted on this website. Investing in securities, especially those issued by start-up companies, involves substantial risk. investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. |

Leave a comment