Professor Glenn A. Okun

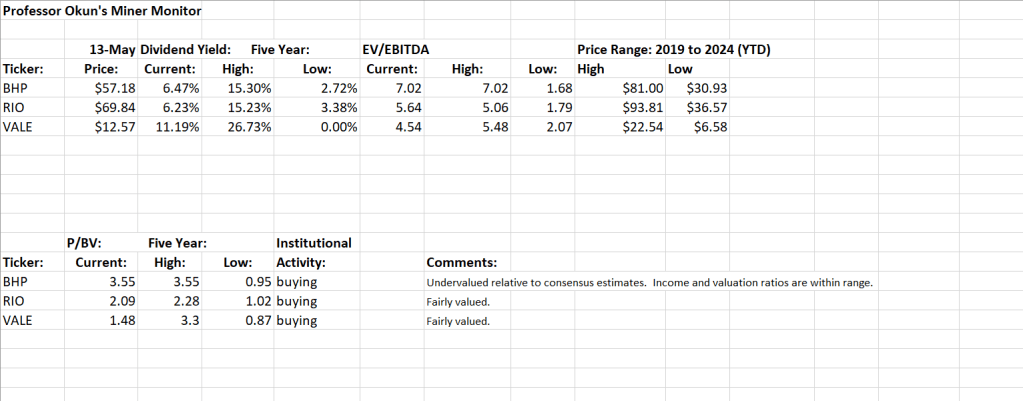

It is inevitable that minerals will become the dominant centenary trend of the natural resources world. There are short, intermediate and long-term sources of demand that will fuel this outcome. In September 2023, the Rabid Capitalist recommended investments in Rio Tinto (RIO), Vale (VALE) and BHP (BHP) as the most effective approach for taking advantage of these secular developments (see https://therabidcapitalist.com/2023/09/11/green-energy-it-is-easy-being-green/). These stocks have become more attractive over the last eight months.

RIO, VALE and BHP provide investors with a compelling combination of current yield and capital appreciation. Their risk profiles are highly attractive as well.

Expected returns are significant.

These firms provide investors with significant dividends. They have committed to a capital allocation policy reminiscent of the oil and gas majors’ approach launched five years ago, balancing capital expenditures required for developing reserves, the source of capital appreciation, with cash distributions in the form of dividends.

The miners’ commodities reserves can serve demand in the old and new economy. These minerals are critical for industry generally and military hardware specifically. The trio intend to be major suppliers for the electric-vehicle market, through their domination of the nickel market. Their vast copper mining operations are also best positioned to profit from the transition to electrical energy.

It is unusual for an industry to be positioned to exploit short, intermediate and long-term demand trends. In the short term, miners will benefit from general economic expansion as industrial firms ramp up manufacturing. The restocking of military hardware will drive purchases as a result of the United States’ supplying munitions and other equipment to combatants in conflicts around the world.

In the intermediate time frame of a decade or more, the expansion of the electrical grid has become mandatory. This infrastructure investment is required in order to accommodate the growing demand for conventional and alternative power, not only for environmental benefits but also for energy-intensive artificial intelligence applications and data center operations.

The long-term transition to green-powered transportation will require vast commodity supplies over many decades. Our miners are among a relatively small number of firms that can possibly meet this need.

Risk management characteristics are numerous.

These companies possess attractive risk profiles by virtue of diversification. These firms produce all major minerals, including iron ore, aluminum, copper and nickel. In addition to their commodity and geographic market diversification, they serve multiple large commercial markets further diversifying their revenue and cash flow streams.

These suppliers mitigate clean energy’s technological innovation risk as well. The major miners, as dominant suppliers, possess a breadth of commodity assets that position them as essential vendors and beneficiaries regardless of the resolution of the uncertainties inherent in the green energy transition.

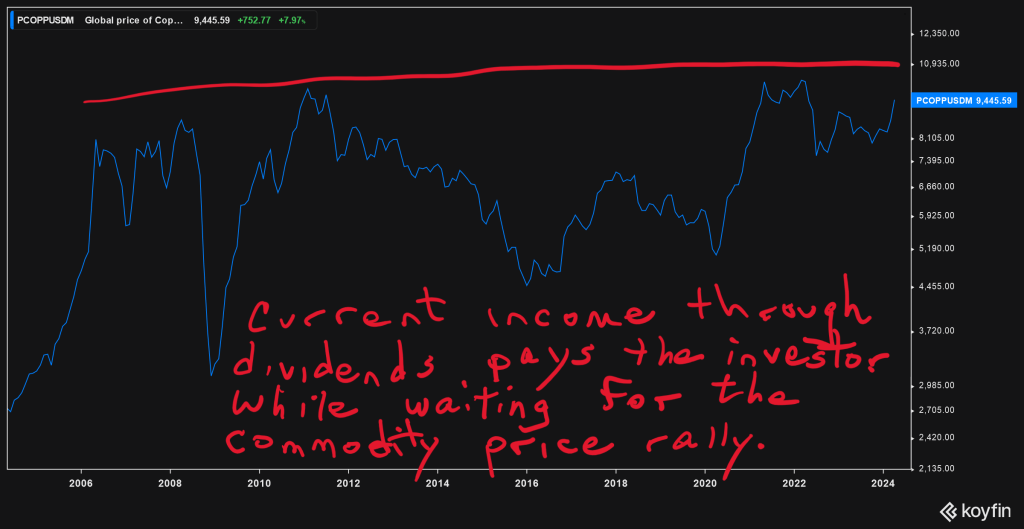

Their high dividend yields protect shareholders from the uncertain timing of the green energy and electrification transitions. Technological innovation in energy is unpredictable (see https://therabidcapitalist.com/2023/09/11/green-energy-it-is-easy-being-green/ and https://therabidcapitalist.com/2023/09/20/generative-ai-stunt-or-transformative-tech/ ). The clean energy future relies on many inventions and discoveries that have not yet occurred (EV batteries for example). Effectively, the investor is being paid to wait until these demand sources provide rewarding capital appreciation.

Current income protects the investor from the delayed demand that has been typical during green energy investment cycles. Historically, once economic growth slows, nations cut a variety of discretionary expenditures, including subsidies that drive green compliance. These adjustments usually take the form of postponing compliance deadlines and reducing the compliance requirements, damaging revenue streams for solutions providers and their suppliers.

Attractive short-term performance.

We have been paid to wait since establishing our positions in these miners.

Long-term stock prices have very high potential rewards.

The Rabid Capitalist expects our mining portfolio to generate compound annual returns in excess of twenty percent over the long term based upon the historical evolution of oil prices. Oil demand increased five times and prices surged by a factor of thirty-five during the mass adoption of the automobile between 1910 and 1946.

This scenario is conservative due to the nature of mining. I expect that supply shortages will drive up commodity prices over time. Copper production from existing mines is forecasted to decline in the short to intermediate term. Capital investment has been declining. Development of a producing mine requires an average of sixteen years, compared to three years for an oil well. The mining industry is much more concentrated than the oil and gas industry, reducing the risk of intense price competition.

These miners remain fairly valued.

RIO, VALE and BHP remain reasonably priced. The geopolitics of copper has begun to attract the attention of governments and the press. The threat of China’s controlling reserves and the current response of the United States should focus investors’ attention on these stocks.

The Rabid Capitalist reiterates its investment recommendation on these miners. Long-term performance will be highly rewarding.

| DISCLAIMER: The Rabid Capitalist and all of its associated properties are owned by Cognitor Consulting LLC (“Cognitor”). Cognitor is a publisher of financial information. |

| Cognitor is not a financial adviser. Cognitor does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser. |

| THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION |

| No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. |

| The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions. |

| Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Cognitor undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material. |

| Cognitor does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. |

| By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law. |

| Cognitor publishes content through WordPress, an email newsletter platform. By accessing Cognitor’s content, you agree to be bound by the Terms of Use and Privacy Policy, in effect at the time you access this website or any page thereof or any of Cognitor’s content. The Terms of Use and Privacy Policy may be amended from time to time. Nothing on this website or Cognitor constitute an offer to sell, or a solicitation of an offer to buy or subscribe for, any securities to any person in any jurisdiction where such an offer or solicitation is against the law or to anyone to whom it is unlawful to make such offer or solicitation. Cognitor is not an underwriter, broker-dealer, Title III crowdfunding portal or a valuation service and does not engage in any activities requiring any such registration. Cognitor does not provide advice on investments or structure transactions. Offerings made under Regulation A under the U.S. Securities Act of 1933, as amended (the “Securities Act”) are available to U.S. investors ONLY who are “accredited investors” as defined by Rule 501 of Regulation D under the Securities Act well as non-accredited investors, who are subject to certain investment limitations as set forth in Regulation A under the Securities Act. In order to invest in Regulation A offerings, investors may be asked to fill out a certification and provide necessary documentation as proof of your income and/or net worth to verify that you are qualified to invest in offerings posted on this website. All securities listed on this site are being offered by, and all information included on this site is the responsibility of, the applicable issuer of such securities. Cognitor does not verify the adequacy, accuracy or completeness of any information. Neither Cognitor nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy, valuations of securities or completeness of any information on this site or the use of information on this site. Neither Cognitor nor any of its directors, officers, employees, representatives, affiliates or agents shall have any liability whatsoever arising from any error or incompleteness of fact, or lack of care in the preparation of, any of the materials posted on this website. Investing in securities, especially those issued by start-up companies, involves substantial risk. investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. |

Leave a comment