Professor Glenn A. Okun

The weak end of the venture capital industry, approximately 80 percent of firms operating today, employs a rigor -free investing process. They are punch-drunk sailors that attempt to trade the private capital markets by throwing money at themes, not ventures. They rely on manic acquirers and the initial public offering market to provide exits for these concept investments in order to bail them out of fundamentally unsound private companies. While venture capitalists that play this game of musical chairs may make money occasionally, their counterparties often get burned. The online meal delivery industry, a creature financed by venture capitalists, is a classic example of this approach.

The online food delivery space was a creature of the gig economy theory. Platforms could match temporary workers on a one-off basis to do tasks as needed. Gig businesses were based on the erroneous notion that the next generation of workers wanted to avoid commitments, prizing their freedom over maximum income. These ventures relied on the idea that consumers would pay high prices for task-oriented services performed by itinerant laborers as a substitute for the customers’ efforts.

Many gig ventures, including food delivery firms, had a moment of high demand during the pandemic. Necessity dictated that consumers pay for these services because lockdown conditions precluded their own efforts.

Venture capitalists threw kerosene on the capital destruction bonfire by funding these ventures in their pursuit of market share over profitability. It should not surprise anyone that these firms were not only unprofitable during the customer acquisition phase when they bought market share with discounted prices subsidized by venture capital, but also during the last few years when customers refused to pay market prices.

These venture capitalists have been culpable of backing firms with foreseeably bad business models and low perceived value, imitable service offerings. Consumers have been unwilling to pay high fees for a low value-added service. They readily have substituted their own effort in order to avoid being gouged.

The market share over margin approach has had a long history of failure, defined as bankruptcy or unsatisfactory return on investment. During previous investment bubbles, venture capitalists funded the pursuit of eyeballs and clicks with subsidized, below-market prices, leading to the destruction of capital, jobs and firms.

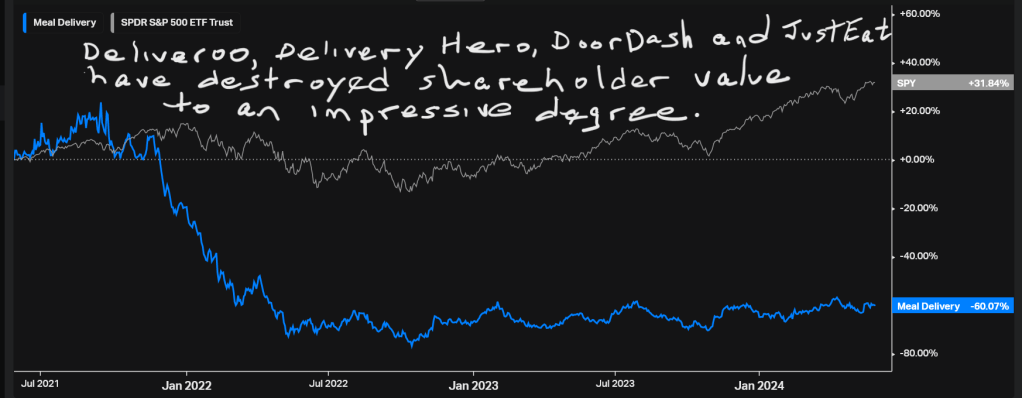

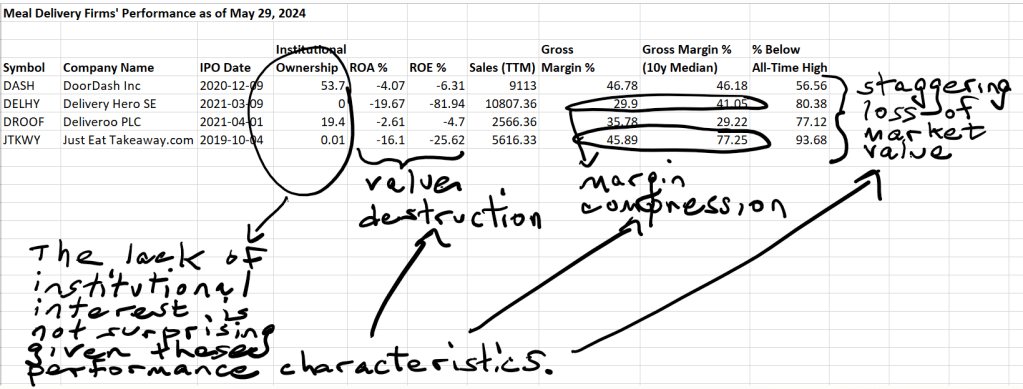

The meal delivery firms, specifically Deliveroo, Just Eat Takeaway, Delivery Hero and DoorDash, have generated massive operating losses. Investors have been abandoning their stocks as a result. Massive investment losses have been incurred.

The aforementioned firms cannot generate acceptable financial performance under these conditions. It is not surprising that they are abandoning their strategy or attempting product expansion strategy in the hope that they can deliver other goods for improved financial results.

The Rabid Capitalist anticipates that these companies are dead ends. Venture capitalists deserve credit for funding start-ups with foreseeably unproductive strategies and business models. Acquirers and public equity investors should avoid them.

| DISCLAIMER: The Rabid Capitalist and all of its associated properties are owned by Cognitor Consulting LLC (“Cognitor”). Cognitor is a publisher of financial information. |

| Cognitor is not a financial adviser. Cognitor does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser. |

| THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION |

| No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. |

| The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions. |

| Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Cognitor undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material. |

| Cognitor does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. |

| By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law. |

| Cognitor publishes content through WordPress, an email newsletter platform. By accessing Cognitor’s content, you agree to be bound by the Terms of Use and Privacy Policy, in effect at the time you access this website or any page thereof or any of Cognitor’s content. The Terms of Use and Privacy Policy may be amended from time to time. Nothing on this website or Cognitor constitute an offer to sell, or a solicitation of an offer to buy or subscribe for, any securities to any person in any jurisdiction where such an offer or solicitation is against the law or to anyone to whom it is unlawful to make such offer or solicitation. Cognitor is not an underwriter, broker-dealer, Title III crowdfunding portal or a valuation service and does not engage in any activities requiring any such registration. Cognitor does not provide advice on investments or structure transactions. Offerings made under Regulation A under the U.S. Securities Act of 1933, as amended (the “Securities Act”) are available to U.S. investors ONLY who are “accredited investors” as defined by Rule 501 of Regulation D under the Securities Act well as non-accredited investors, who are subject to certain investment limitations as set forth in Regulation A under the Securities Act. In order to invest in Regulation A offerings, investors may be asked to fill out a certification and provide necessary documentation as proof of your income and/or net worth to verify that you are qualified to invest in offerings posted on this website. All securities listed on this site are being offered by, and all information included on this site is the responsibility of, the applicable issuer of such securities. Cognitor does not verify the adequacy, accuracy or completeness of any information. Neither Cognitor nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy, valuations of securities or completeness of any information on this site or the use of information on this site. Neither Cognitor nor any of its directors, officers, employees, representatives, affiliates or agents shall have any liability whatsoever arising from any error or incompleteness of fact, or lack of care in the preparation of, any of the materials posted on this website. Investing in securities, especially those issued by start-up companies, involves substantial risk. investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. |

Leave a comment