Professor Glenn A. Okun

The Rabid Capitalist: The Big Point is a brief summary of a detailed note available to paid subscribers.

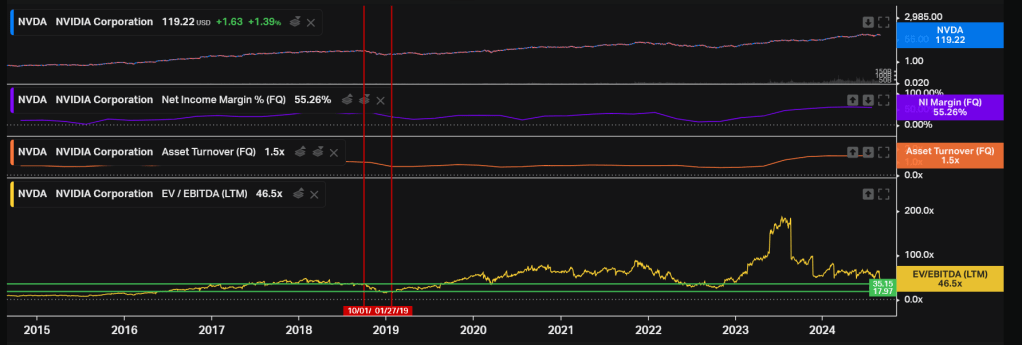

The Rabid Capitalist has described Nvidia as being priced for perfection. Its high valuation has a basis in investors’ expectations for high margins and high growth rates in revenues, earnings and cash flows. The risk for stockholders is excellent financial results that fall short of perfection. We can observe the consequences of a less-than-perfect quarterly report on the share prices of Nvidia and Cisco throughout history.

The principle of market expectations driving stock market performance has been evident for Nvidia and Cisco. Investors occupy a relative, not an absolute, universe in terms of a firm’s financials and valuation.

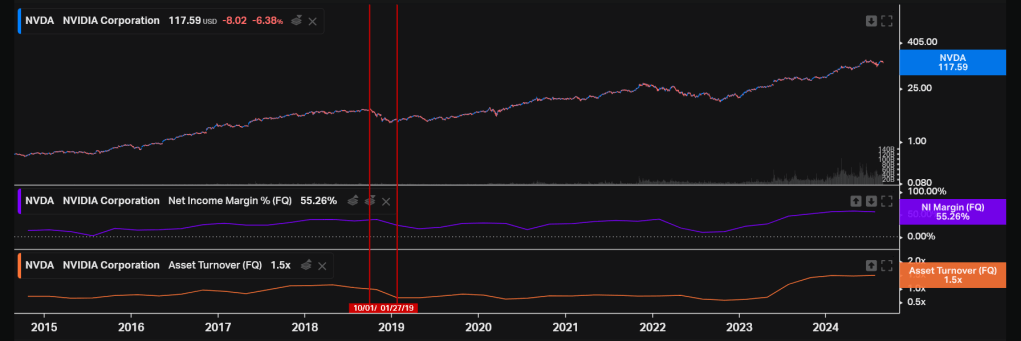

While the current Nvidia sell-off, that chopped approximately $200 billion off its market capitalization, illustrates this issue, there has been a starker example of investor disillusionment in the firm’s past. When Nvidia’s net margin and asset turnover declined by twenty-eight and thirty percent respectively between its third and fourth calendar quarter of 2018, its valuation collapsed by fifty percent as measured by its EV/EBITDA multiple.

Complete content is available for a $15 monthly subscription. Click here to subscribe:

Leave a comment