Professor Glenn A. Okun

The Rabid Capitalist: The Big Point is a summary of a detailed note available to paid subscribers.

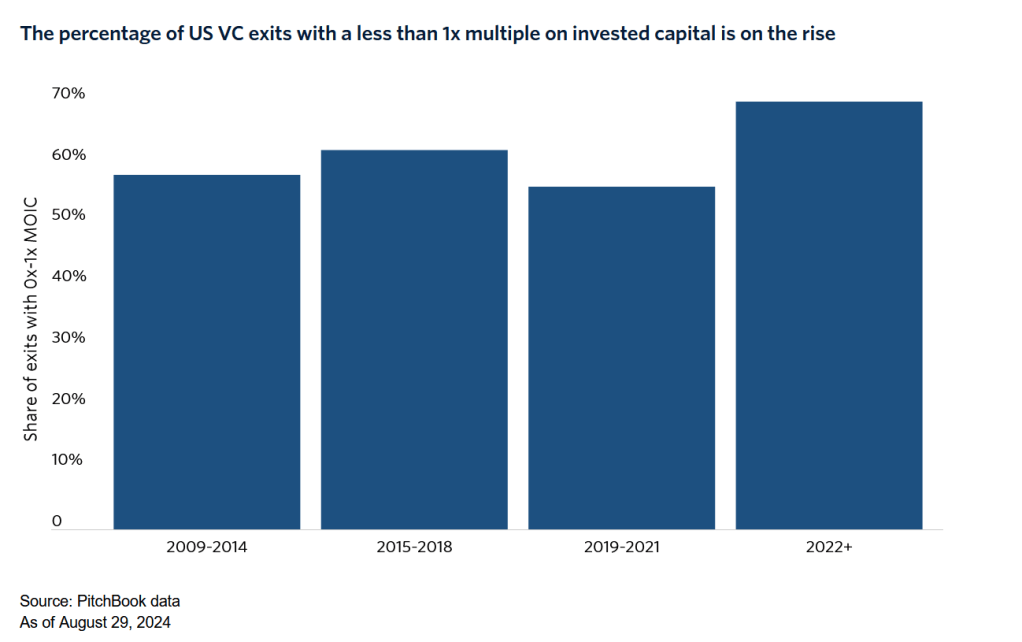

The Rabid Capitalist has previously described the venture capital fund formation cycle. In short, a high volume of exits at high values relative to capital invested through initial public offerings and mergers and acquisitions create attractive fund IRRs that attract larger commitments by institutions to new funds, increasing the supply of capital available to ventures. Unfortunately, this cycle can run in reverse and has continued to do so through the third quarter.

Bad exits cause weak fund performance.

Complete content is available for a $15 monthly subscription. Click here to subscribe:

Leave a comment